Summary

Tranchess, at a basic level, creates the opportunity to enhance returns on a crypto asset by ‘boosting’ staking rewards earned through the native CHESS token. By testing the boost factor algorithm, identifying its sweet spot, and stress-testing with price crash scenarios, we found it is possible to generate an optimal, actionable trade recommendation capable of withstanding market shocks.

Tranchess is an asset-tracking protocol on the Binance Smart Chain (BSC) that launched in June 2021. It offers a matrix of risk-return strategies based on a main fund consisting of either BTC or ETH (recently added).

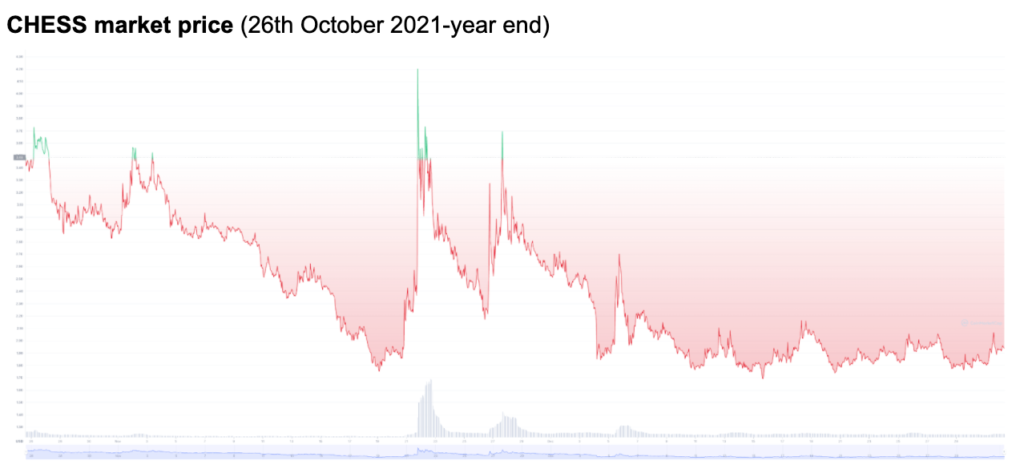

The platform attained a peak TVL of $1.9bn in October 2021, and has since experienced a sharp decline to $1.15bn (-65%), owing in part to the falling price of BTC in the last few months of the year.

How Tranchess works

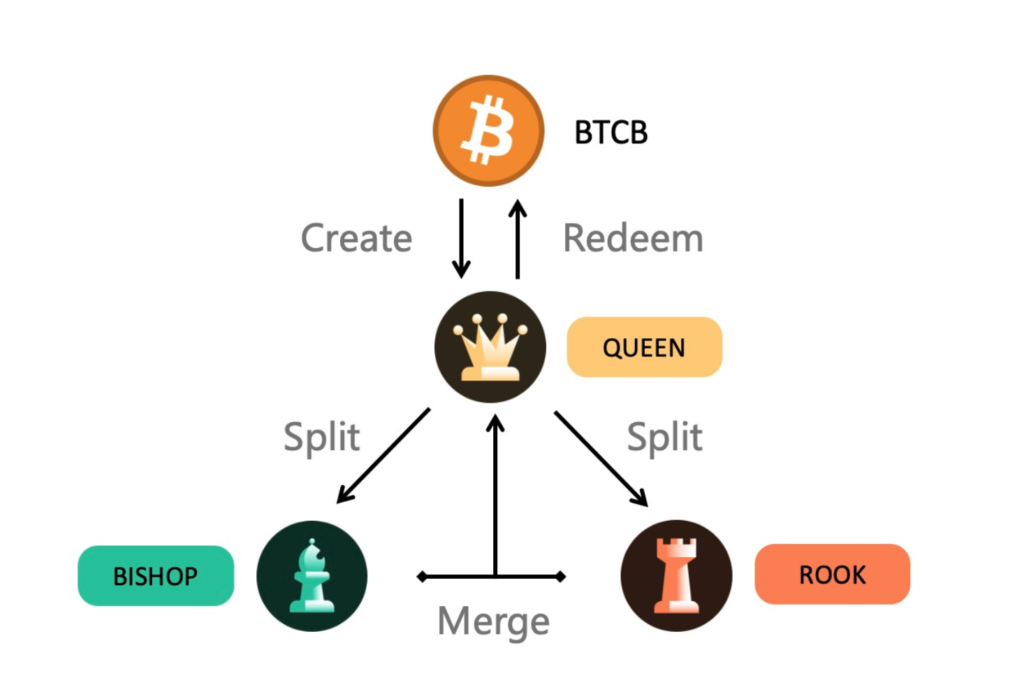

The protocol consists of three tranches, each represented by a token named after a chess piece (tranch + chess), and offering different levels of risk and return exposure:

- QUEEN = Own BTC / ETH

- BISHOP = Lend USDC

- ROOK = Leveraged ownership of BTC

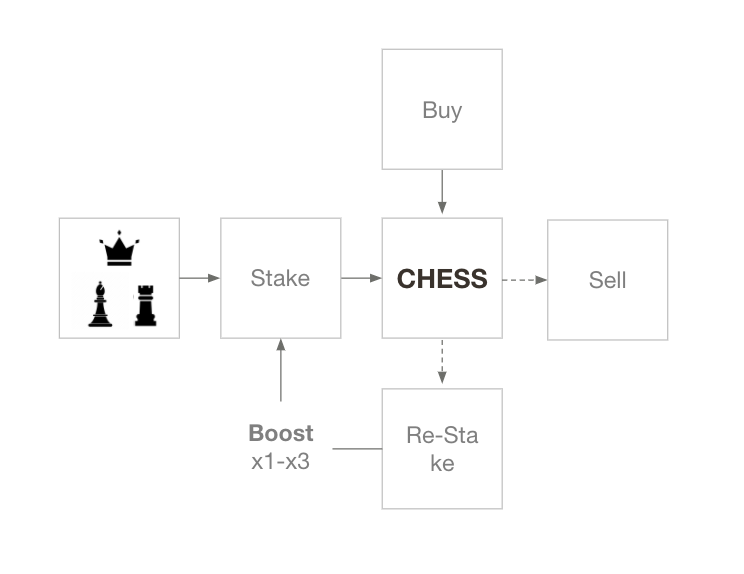

All three tokens can be staked (with no lock-in period) to earn CHESS tokens (CHESS tokens can also be bought outright). CHESS tokens can either be withdrawn in real-time, or staked to earn a “Boost Factor” that increases the APR earnable on the three ‘pieces’.

A more complete explanation of this protocol is available here. In this article, we’ll be focussing on a yield maximizing strategy involving QUEEN (=BTC/ETH) and CHESS.

Context of our study

For us, the main draw of Tranchess is the opportunity to achieve enhanced returns on BTC (the only available asset at the time of the study) by taking advantage of the Boost Factor.

The Boost Factor is calculated in a non-linear fashion, using a complex formula that is hard to simulate analytically.

At a high level, the Boost Factor is:

- Positively correlated with the staking duration period (1,4,12, or 25 weeks)

- Dependent on the mix and volume of the base token (QUEEN, ROOK, BISHOP) and CHESS token (e.g. more QUEEN requires more CHESS to achieve the same mix, and associated boost).

Finding the optimal strategy is not as simple as finding the correct mix to unlock the maximum boost factor, however. The CHESS coin can decline in value, and so staking a higher amount for a longer period exposes the investor to greater potential loss.

At the time of our study (2021-10-26), staking QUEEN to earn CHESS rewards delivered a basic (i.e. no Boost Factor) APR of 8.30%. This is just above the borrowing rate for USDC (assumed as the cost of capital rate) available on Compound (7.24%) on the same date.

We calculate return by offsetting the staking returns against the decline in the value of CHESS, the net of which is the advantage accrued from exchanging BTC for QUEEN.

Initial analysis

The key sensitivity factors are therefore:

- The extent of the decline in the value of CHESS

- The length of lock-in period

All other things being equal, one would expect the effect of a decline in the value of CHESS to be magnified by a longer lock-in period. In other words, the more severe the decline, the shorter the optimal lock-in period.

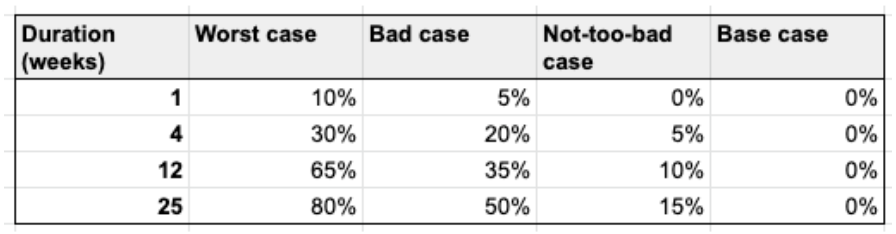

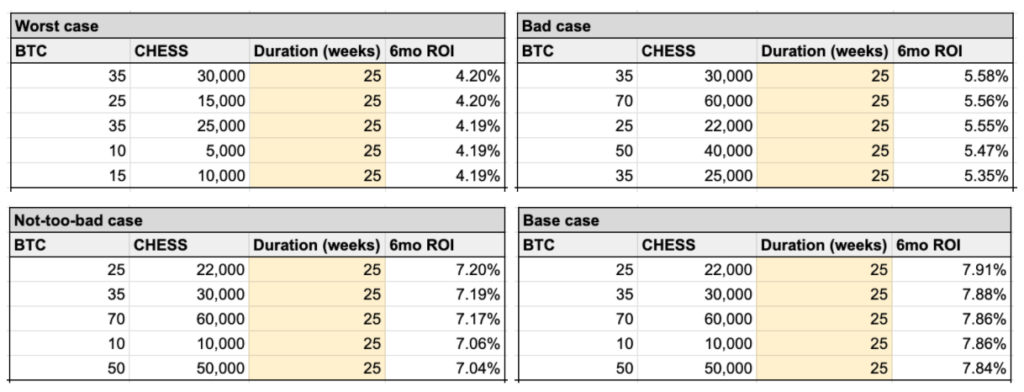

To test this, we constructed four scenarios, varying the extent of the decline, and ran the analysis for each duration, from worst to best case.

The results showed that a duration of 25 weeks delivered the highest returns without exception, with the mix of QUEEN (≅BTC) to CHESS playing a secondary role.

This demonstrates that the Tranchess team are heavily skewing the Boost Factor to reward long-term staking.

Confirm lock-in period

The initial analysis assumed that the earned CHESS was exchanged for USDC after the lock-in period and lent out at the Compound cost of capital rate (i.e. not re-staked).

Re-staking would continue to magnify the returns, and could be a smart way to preserve the effects of the boost while retaining the optionality to sell the CHESS tokens in case of a market decline. Therefore we decide to incorporate this into the analysis.

Instead of modeling a simple decline at the end of the lock-in period, we modeled the scenarios on a week-by-week basis.

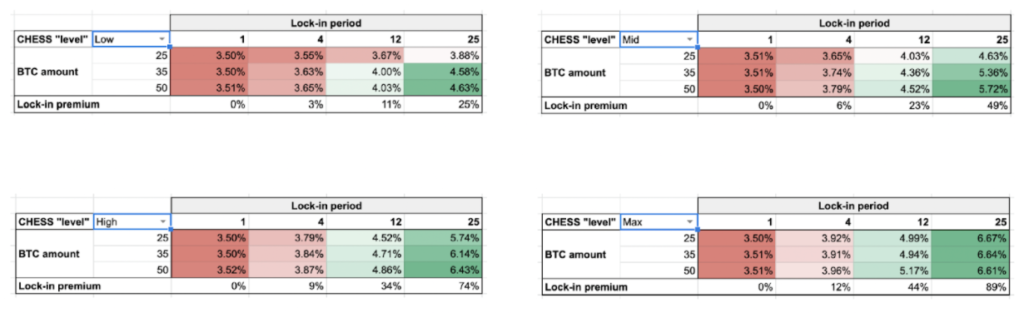

As a control, we started with a flat scenario in which there is no change in the market price of CHESS. Varying the amount of QUEEN and CHESS staked, we calculated the ‘lock-in premium’ – i.e. the % increase in returns resulting from extending the duration.

We narrowed the range of QUEEN to 25-50 BTC. The CHESS values fell within a natural range starting from Low (minimum amount of CHESS required to increase the Boost Factor above x1.0) and Max (the CHESS required to increase the Boost Factor to x3.0).

In this scenario we saw the 25-week lock-in period always outperforms the other periods, regardless of the amount of CHESS.

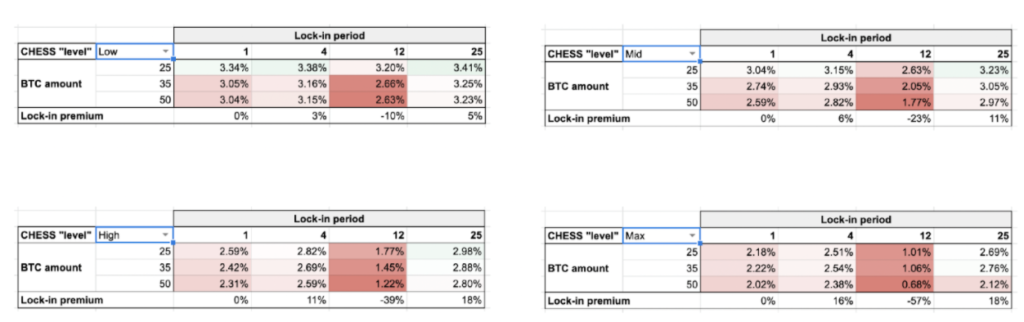

To stress-test the strategy, we then created a scenario with a severe crash (-85%) overall occurring from weeks 19-25, which would in theory favor the shorter-term durations and punish the 25-week duration.

In this scenario we found that the same conclusion applied: 25 weeks dominates as a strategy. This is in spite of the factor that the shorter duration periods (1,4) would exchange CHESS for USDC and lend out on Compound from week 20 onwards.

Confirm CHESS level

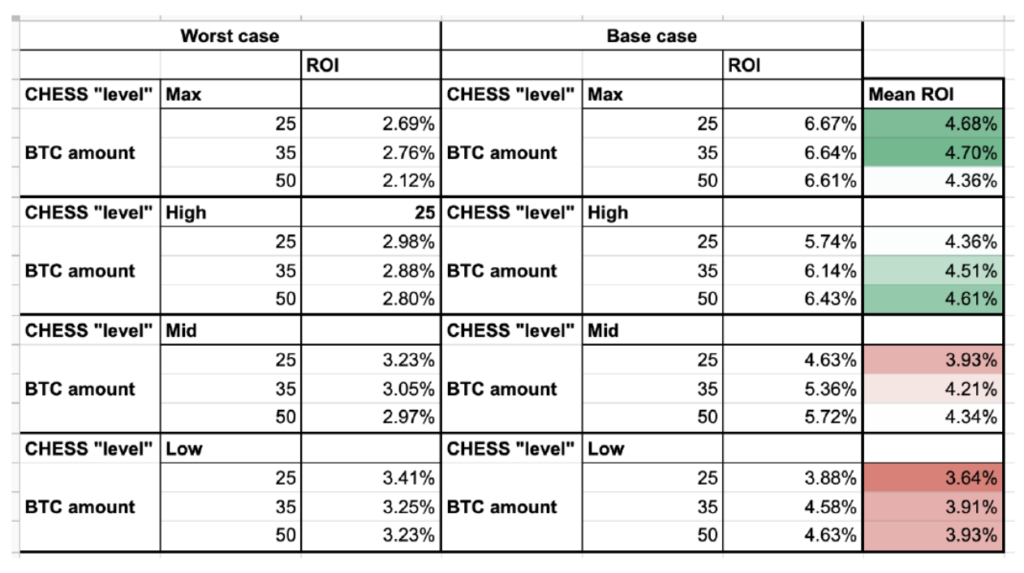

As a final step, we wanted to calculate a concrete level of BTC and CHESS to determine an actionable trade. We did this by taking the mid-point of the best (i.e. no change) and worst-case scenarios for the four Chess ‘levels’, which yielded the highest terms overall.

These results reveal 35 BTC combined with 30,000 CHESS to be the optimal investment, although not by a significant amount.

Conclusion

The price of CHESS has in fact fallen by a considerable amount (-46%) since the analysis was conducted, demonstrating that the assumptions were reasonable, and that this was the correct variable to flex in order to stress-test the strategy.