The aphorism “scratch your own itch” is usually doled out as advice for startup founders rather than investors, but since AlphaLab is first and foremost an operating business, we have plenty of itches. Recently we invested in a company, Atato, that addresses a major itch for us and many other crypto firms: custody.

AlphaLab Capital is a quant trading group that operates on 40+ centralized exchanges and 20+ DEXs. We have thousands of unique exchange accounts, sub-accounts, and wallets. Security and operational efficiency are two major concerns for us, and unfortunately they are often direct trade-offs.

For years, the operational inefficiencies of transferring funds was a major bottleneck for us. For security reasons, very few team members had access to transfer funds between accounts and active collaboration was required as part of the security mechanism. That was fine in the beginning when we were a small firm trading on just a handful of exchanges, but as we grew, these people had to spend more and more of their time doing these transfers until it was taking up hours every single day. The inefficiencies were causing frustrations and starting to hamper our growth as a firm.

This custody and treasury management problem is not unique to us. Any trading desk, hedge fund, liquid token fund, or asset manager who is operating at any kind of scale faces similar problems. In traditional finance, you can separate control from ownership and give detailed permissions on control of an account to different individuals, but in crypto, ownership and control are still inextricably, frustratingly linked.

Over the years we’ve built our own tools to address the most frustrating parts of custody and treasury management. We also actively evaluated existing solutions for custody and treasury solutions, but there were still major limitations with both our in-house and existing products.

In October 2021, we were introduced to Guillaume and Maxime who had just completed the public launch of Atato. They personally gave us a demo and we were immediately impressed by their openness, thoughtful approach, and sophisticated understanding of both the market and user pain points. They also happily granted us access to a live instance to explore on our own, which very few startups will do and indicates that the founders have exceptionally strong confidence in their product.

We dived into Atato’s product in depth, and found even more to like:

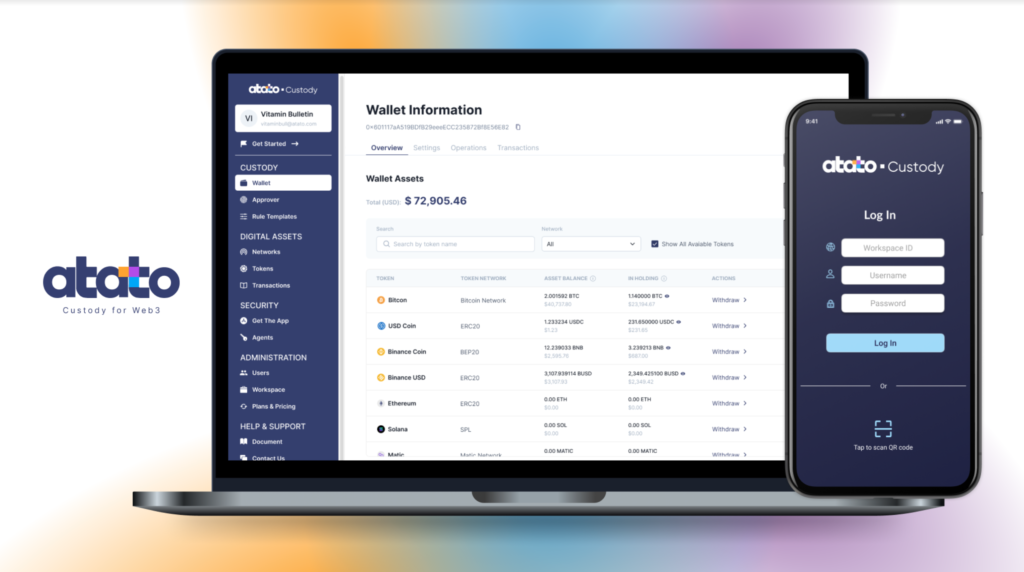

- User-friendly UI, easy onboarding, and open API access. Having demo-ed or tested just about every other custody solution in the market, we can confidently say this is truly unique.

- Institution-grade security that also allows for humans to be human (i.e. fallible). Whereas the first generation of custody providers used multisig, Atato uses multi-party computation.

- “Bring Your Own Chain” (BYOC), which allows Atato to be a single wallet supporting all chains. For any other custody provider to support a new token, you must wait at the mercy of their engineering team’s product roadmap. On Atato, rather than submitting endless support tickets to an overworked product manager, you can custody any new chain you want with about a week of development work. This creates a nice network effect as each new chain that any user integrates becomes available to all users. We think this will be a killer feature.

- A competitive business model. Atato charges a flat fee based on the number of users, whereas competitors charge based on assets under management (AUM) or number of transactions.

Guillaume and Maxime’s long-term vision for Atato is to replace existing software-based wallets with a more secure, easy-to-use, and flexible solution. We are aligned with their vision, and for all these reasons, we are excited to announce that we have led Atato’s $6 million Series A round. This is particularly exciting for us because it represents our very first foray into leading a venture round. We are thrilled to invest alongside Febe, NGC Ventures, NFT1 and other influential crypto angels, to be working alongside Atato’s exceptionally thoughtful founders, and to make better custody services available to the entire crypto ecosystem.